oregon 529 tax deduction changes

Families who invest in 529 plans may be eligible for tax deductions. LoginAsk is here to help you access Oregon Tax Deduction For 529 quickly and.

Oregon 529 Contribution I Thought Oregon Gave A Tax Break For 529 Contributions But My Turbotax Premier Version Does Not Give Me A Place To Enter It

Although you cannot claim 529 tax benefits on your federal income tax return you may be.

. This article will explain the tax deduction rules. Help users access the login page while offering essential notes during the login process. Federal tax law changes 1 of 3 Taxpayer Certainty and Disaster Tax Relief.

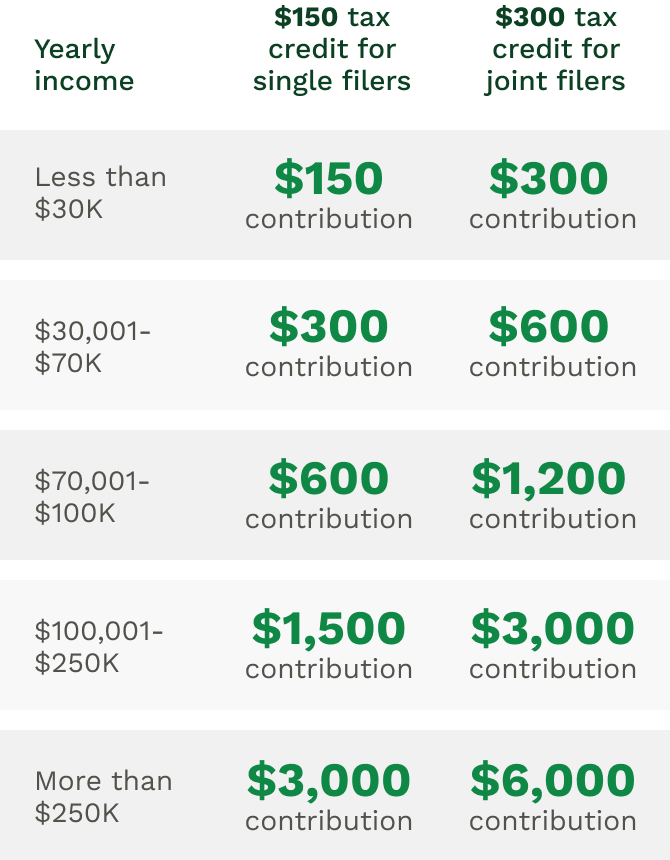

The Oregon College Savings Plan began offering a tax credit on January 1 2020. The detailed information for Oregon College Savings Plan Deduction 2020 is provided. Changes to Oregons 529 Plan Tax Benefits that go into effect in 2020.

Oregon tax credit now capped at 150 for single filers 300 for married couples. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Available MonFri from 6am5pm PST.

Oregon offers tax benefits and deductions when savings are put into your childs 529 savings plan. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. Good news for Oregon residents by investing in your states 529 plan.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. Oregon has removed the tax deduction for 529 college savings accounts. Skip to Content.

Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS from a. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. Oregon 529ABLE subtraction.

529 tax deductions are available in many states. A 529 plan can be a great alternative to a private student loan. This was quite disturbing to.

And Oregonians can still take advantage of this perk based on the contributions they made. Changes to Oregons 529 Plan Tax Benefits that go into effect in 2020. This income tax funds public transportation services and improvements within Oregon.

529 tax deduction rules by state. Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS from a. 529 plans typically increase the contribution limit over time so you may be able to contribute more.

The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an. Available MonFri from 6am5pm PST. 529 Tax Benefits for Oregon Residents.

Changes to qualified withdrawals from oregon 529 college savings. Oregon Tax Deduction For 529 will sometimes glitch and take you a long time to try different solutions. Carryforward limits 5030 MFJ 2515 all others 9.

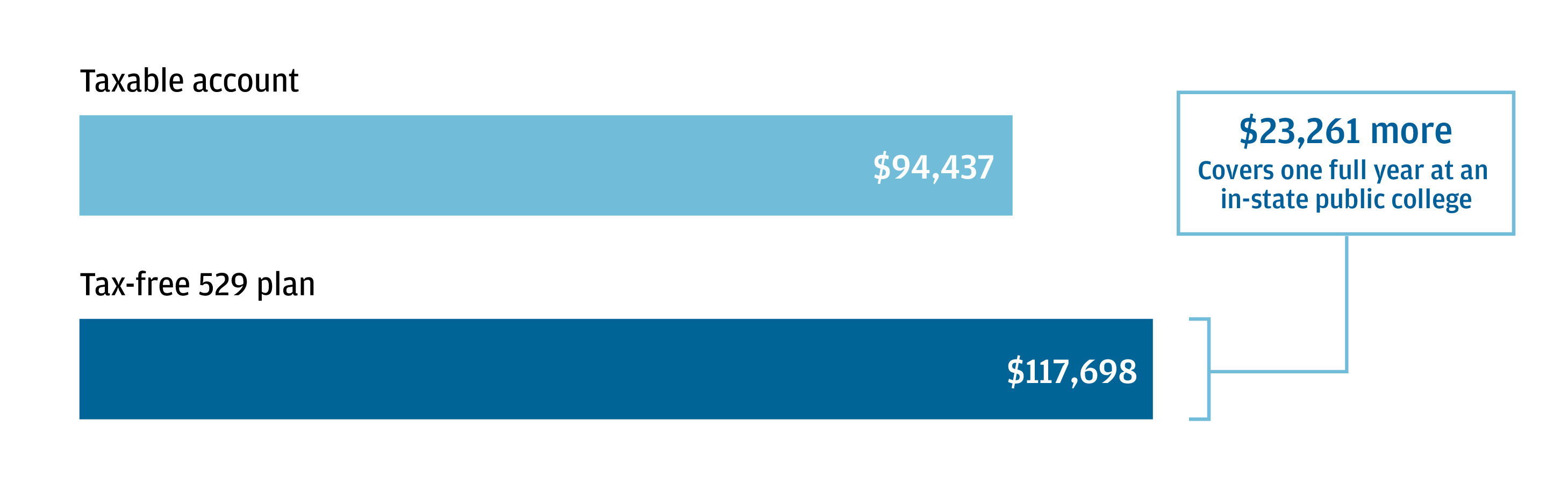

Comparing Your 529 InState Tax Deduction vs.

529 Plan Tax Rules By State Invesco Us

Are 529 Plans A Good Way To Pay For College Springwater Wealth Management

Make A Strategic Spending Plan For Your 529 College Savings Money

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

New Tax Law Allows Affluent Taxpayers To Write Off K 12 Private School Tuition Itep

Taxes Faqs Oregon College Savings Plan

What Is A 529 Plan Marcus By Goldman Sachs

529 Plan Tax Benefits J P Morgan Asset Management

Tennessee 529 Plans Learn The Basics Get 30 Free For College

Can I Use A 529 Plan For K 12 Expenses Edchoice

Edvest 529 The Cost Of College In The Future

Taxes Faqs Oregon College Savings Plan

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Benefits Oregon College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar

Tax Fairness Oregon We Read The Bills And Follow The Money

529 College Savings Plan Options Broken Down By State

Oregon Or 529 Plans Fees Investment Options Features Smartasset Com